In Sage X3, we may come across a scenario where we want to get the data in the Tax field. To solve this functionality:

Navigate to: Common Data → G/L Accounting Tables → General

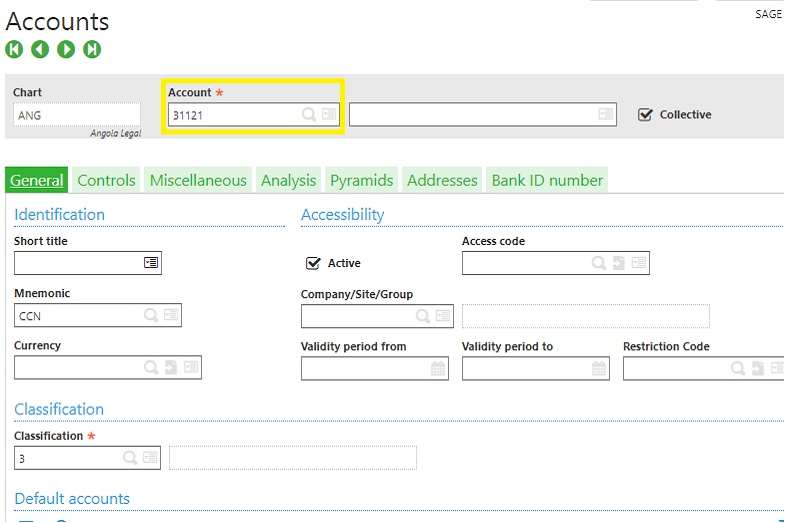

select that account which we used in the Customer BP Invoice.

Account screen

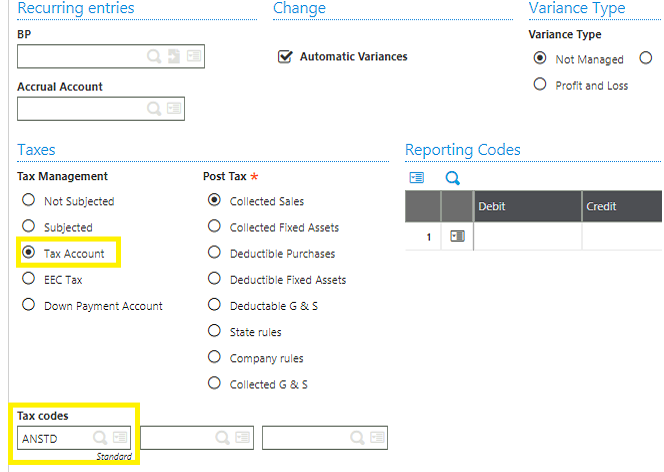

Then, go to the Controls tab

Set ‘Tax Management’ field and ‘Tax Code’ as ‘Tax Account’ and ‘ANSTD’. Refer below screenshot:

Accounts – Controls tab screen

then save it.

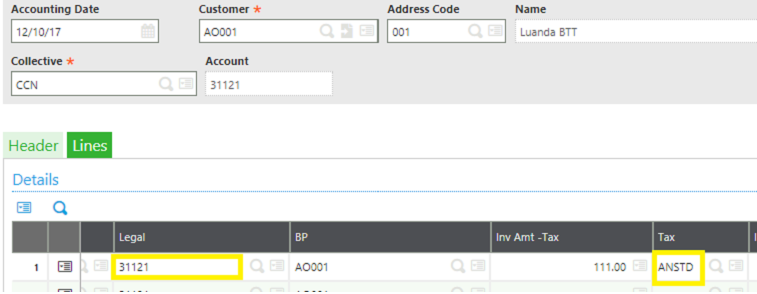

Now, Navigate to: AP / AR accounting code → Invoicing → Customer BP Invoice

Enter all the mandatory fields and check in the line level, it will set by default the data in the tax field which we entered in the Tax Code in accounts screen as shown in below screenshot.

Customer Invoice – lines tab screen

Hope this helps.

About Us

Greytrix is a one stop solution provider for Sage ERP and Sage CRM needs. We provide complete end-to-end assistance for your technical consultations, product customizations, data migration, system integrations, third party add-on development and implementation expertise.

Greytrix has some unique solutions of Sage X3 integration with Sage CRM, Salesforce.com and Magento eCommerce along with Sage X3 migration from Sage 50 US, Sage Pro and QuickBooks. We also offer best-in-class Sage X3 customization and development services to Sage business partners, end users and Sage PSG worldwide.

For more information on Sage X3 Integration and Services, please contact us at x3@greytrix.com. We will be glad to assist you.

Also Read:

- Split Functionality in Purchase Order

- Line Duplication Functionality in Sage ERP – X3

- How to use and setup the functionality of early discount / late charges in Supplier Invoice

- Experience greater control over inventory with the new enhancement in Sage X3 Stock Change functionality

- How to use the basic functionality of grid