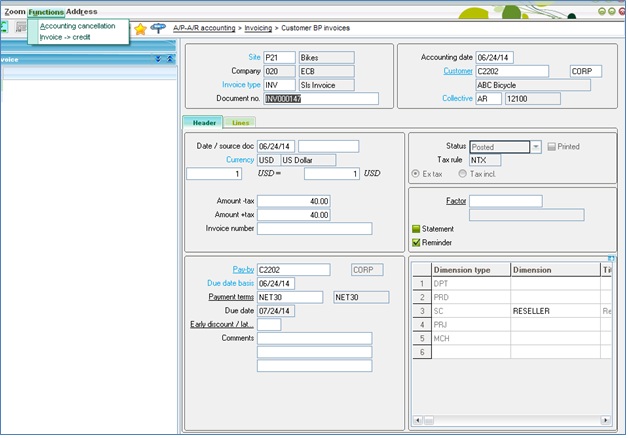

Often there can be a human error while entering invoices and it so happens that we find this anomaly quite later i.e after the Invoices are already posted and Journals are generated for the Invoices. What do we do in such a scenario? Well, X3 provides most efficient and easiest workaround for this problem.

New Stuff: Check Client Type of X3 Session

The Accounting cancellation functionality provides a feasible of X3 deletes the Journals created and open the Invoices which were posted.

Once you confirm the cancelation the Journals created for the Invoice are deleted and the invoices will be open for posting once again.

Once you confirm the cancelation the Journals created for the Invoice are deleted and the invoices will be open for posting once again.

Note: The Sales or Purchase Invoices cannot be canceled using this process and requires a credit or debit notes in order reconcile the Stock movements.

Also Read:

1. Allocate Invoices to Posted Pre-Payments in Sage X3

2. How to check for Accounting codes in X3

3. Setup the payment reminders for multiple customers

4. How to add Sales Invoice elements in X3?

5. How to Assign Default Values to Crystal Reports